Tax Increment Financing

Tax Increment Financing (TIF) utilizes the tax from future gains in real estate values to fund public infrastructure improvements. These improvements serve to increase the value of properties in the TIF district while also encouraging new development in the surrounding area. Districts are typically established for a period of 20 to 25 years, during which time all incremental tax revenues above the base rate at the time the district is established flow into the TIF fund.

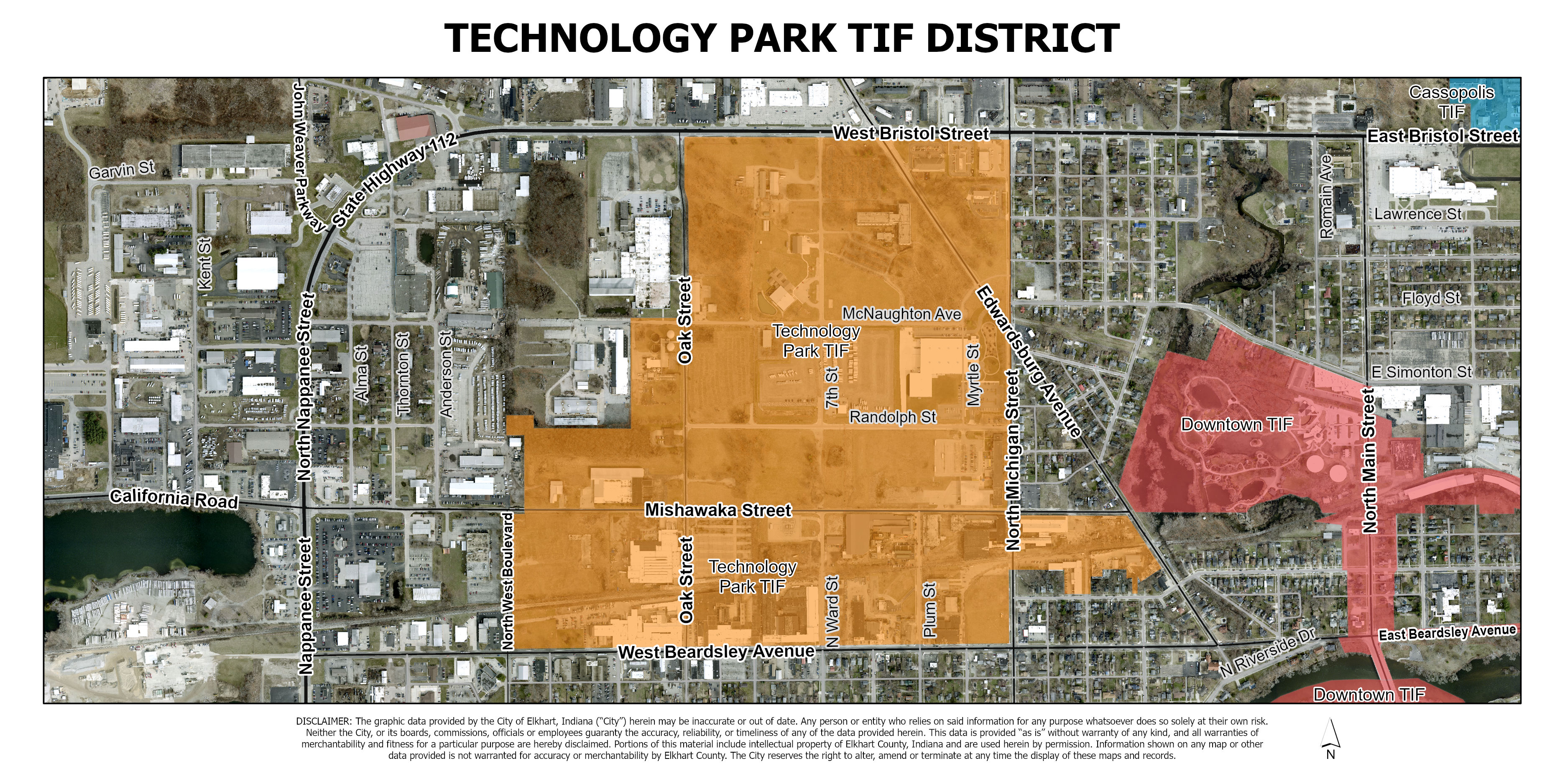

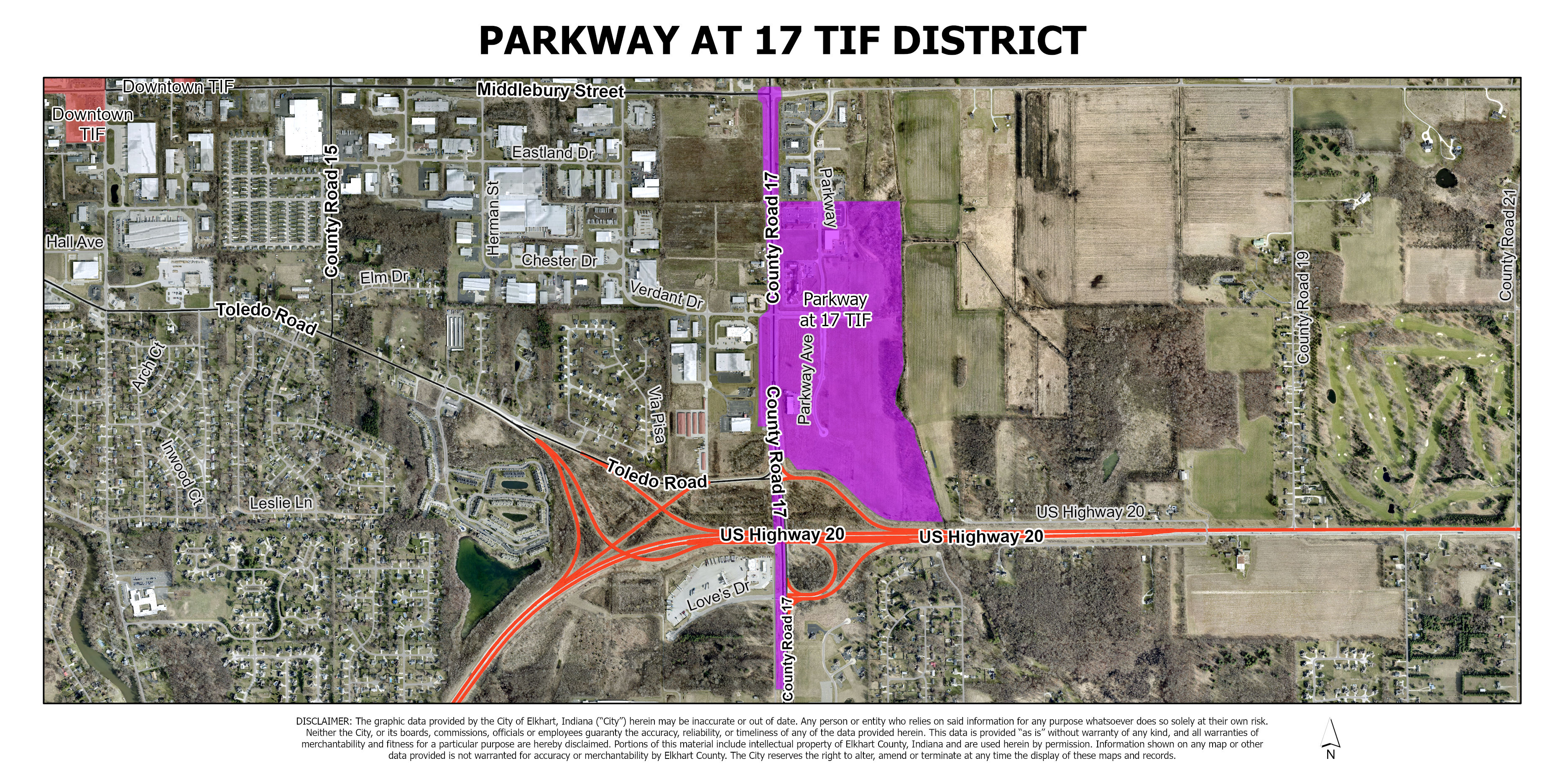

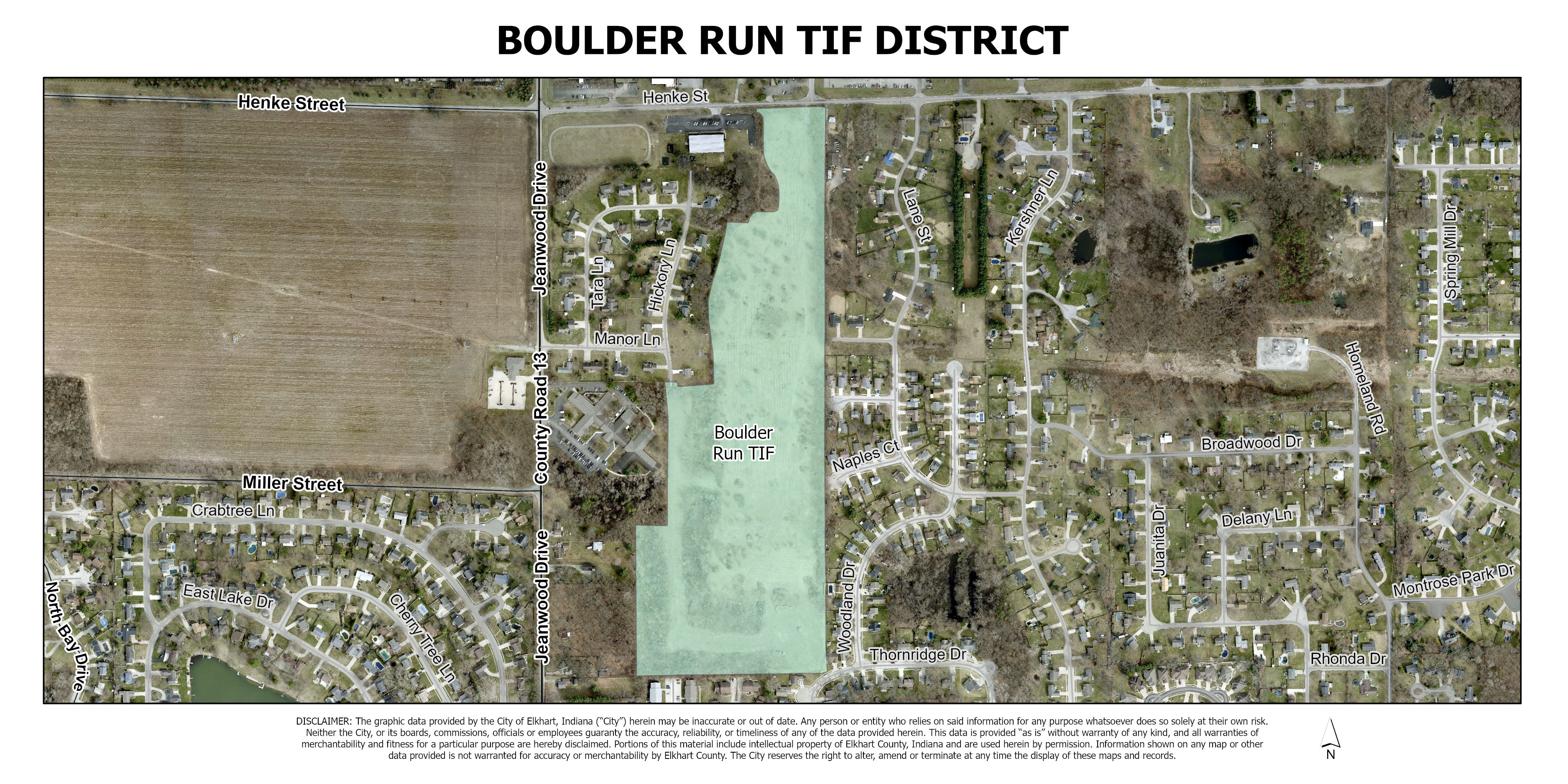

View the city-wide map or scroll down for details on specific TIF districts.

Learn More

To learn how tax increment financing might benefit a specific capitol improvement project for infrastructure improvements or large-scale development, please contact Development Services.

Contact Us

Development Services

📍201 S. 2nd St. Elkhart, IN 46516

Mailing Address: 229 S. 2nd St. Elkhart, IN 46516

Hours: Mon. - Fri. 8 AM - 5 PM EST

Adam Fann, Assistant Director of Redevelopment

Adam.Fann@coei.org

Jacob Wolgamood, TIF Infrastructure Project Supervisor

Jacob.Wolgamood@coei.org